- Have a question?

- 613-89-Prime (77463)

- 1-866-950-3667

- info@primebenefitsgroup.com

The Value of Financial Wellness Programs

We know that financial stress is affecting people more than ever before. There is so much information available that it is difficult to know what to do when it comes to financial planning. The more stress people feel and the more they experience financial uncertainty, the more likely they are to do nothing at all.

Inaction may be a sign of financial information overload, worry about making the wrong investment decision, or struggles with conflicting priorities – saving vs paying down debt.

While many people are uncomfortable talking about their financial situation, they are even less comfortable doing anything to manage their stress on the subject.

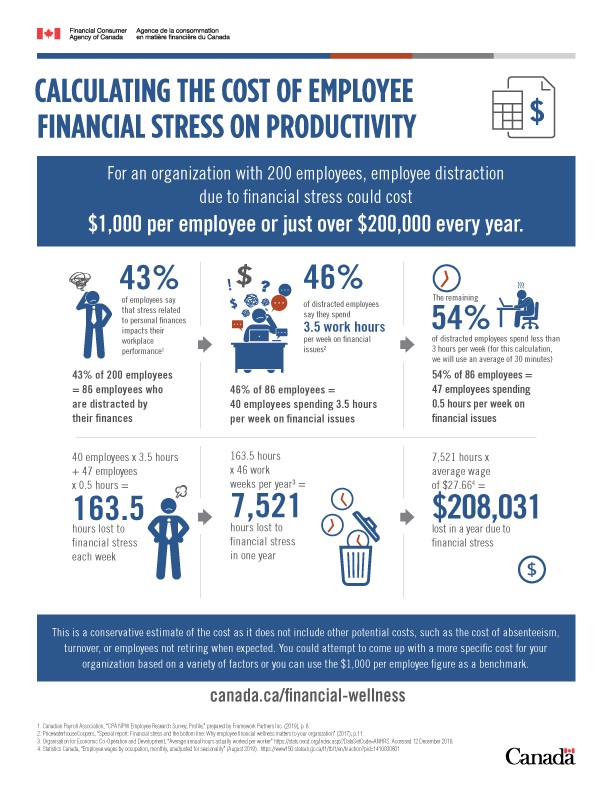

Employers know that when their employees are financially stressed, they are also less productive, take more time off work and experience greater levels of anxiety and other illnesses. (See the infographic, Calculating the Cost of Employee Financial Stress on Productivity.)

A recent CIBC survey indicates that people worry that the effect of COVID-19 will have a negative impact on their savings and retirement plans and that they will need to work longer than planned. In fact, 26 per cent of the survey respondents believe that the pandemic has significantly increased the cost of retiring.

Our current global situation teaches us that we’re not alone and that there are times when we all could benefit from financial advice and support.

On the upside, according to Manulife’s Financial Stress Survey of Canadians, more of us are open to the idea of seeking financial advice to help us weather these trying times.

Who Are Employees Turning To for Support?

These days in particular, it’s understandable that people are nervous about their finances and that they might naturally turn to their employers for support and guidance as a result. Employers can answer this call through the use of financial wellness programs. They are a key way to help employees navigate financially challenging times while boosting their financial acumen and confidence in the process.

Financial Wellness Programs can be a valuable way to:

- Educate and improve financial literacy,

- Provide financial counselling and coaching

- Reduce financial worries

- Help with money management, debt reduction and savings strategies

- Improve retention and recruitment results

Common Program Elements

Common elements of financial wellness programs include: workshops with guest speakers, dedicated partnerships (e.g., financial planners, employee assistance programs), use of financial wellness tools (e-learning and custom training) and benefits such as financial support for student loan repayments.

What’s Available

There are free online workshops, videos and interactive questionnaires available. They can be used to form an important part of the program. The Government of Canada’s Financial Consumer Agency offers many free resources. Additionally CPA Canada has a free interactive questionnaire to help you understand money basics and how they apply to you.

There are many financial wellness tools available for a fee. Two with some uniques features worth highlighting include: Your Money Line which provides personalized digital education and on-demand financial advising with a confidential financial hotline, and Best Money Moves which is a mobile-first financial wellness solution that measures employees’ level of financial stress in 15 categories and then sends employees information and tools to reduce their stress.

As we work our way through the pandemic’s challenges, it is highly probable that employers who make financial wellness programs a priority will help their workforce in innumerable ways. When employees aren’t fretting about student or credit card debt or how to secure access to cash in the event of an emergency, they’ll reward their employers with loyalty and better customer products and services.

Offering an employee financial wellness program can be integrated into employer-provided benefits and that is something we specialize in. We invite you to contact us with your questions. Let’s work together and create solutions that work best for you and your organization.